Choose your focus

You benefit from a diversified investment strategy and make a positive contribution to the environment and society: Your Goldmarie Essential Portfolio contains only stocks of companies that meet our strict sustainability criteria. We continuously adjust the composition to align with your investment goals.

Your Goldmarie Impact Portfolio helps you make the most of your money. You invest in specially selected stocks with a focus on maximizing ecological and social sustainable impact. Not only do you seize opportunities, but you also make a significant contribution to the environment and society.

You get

Consistent Sustainability

A simple investment with saving plan

Real stocks that we manage for you

How to invest with Goldmarie

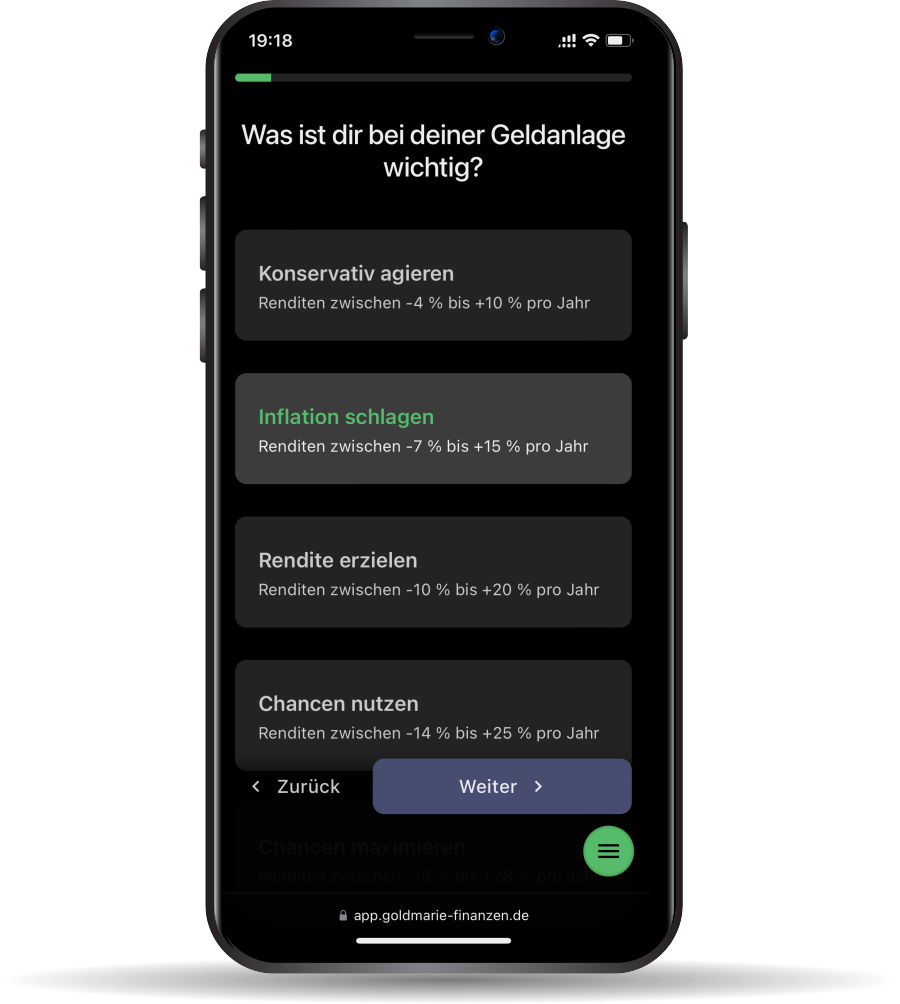

1. Determine your strategy

Choose your strategy and tell us in the online questionnaire what your personal investment goals are.

2. Sign contracts

Based on your investment goals, we will create your personalized investment proposal. If you accept it, we will prepare everything you need for your investment.

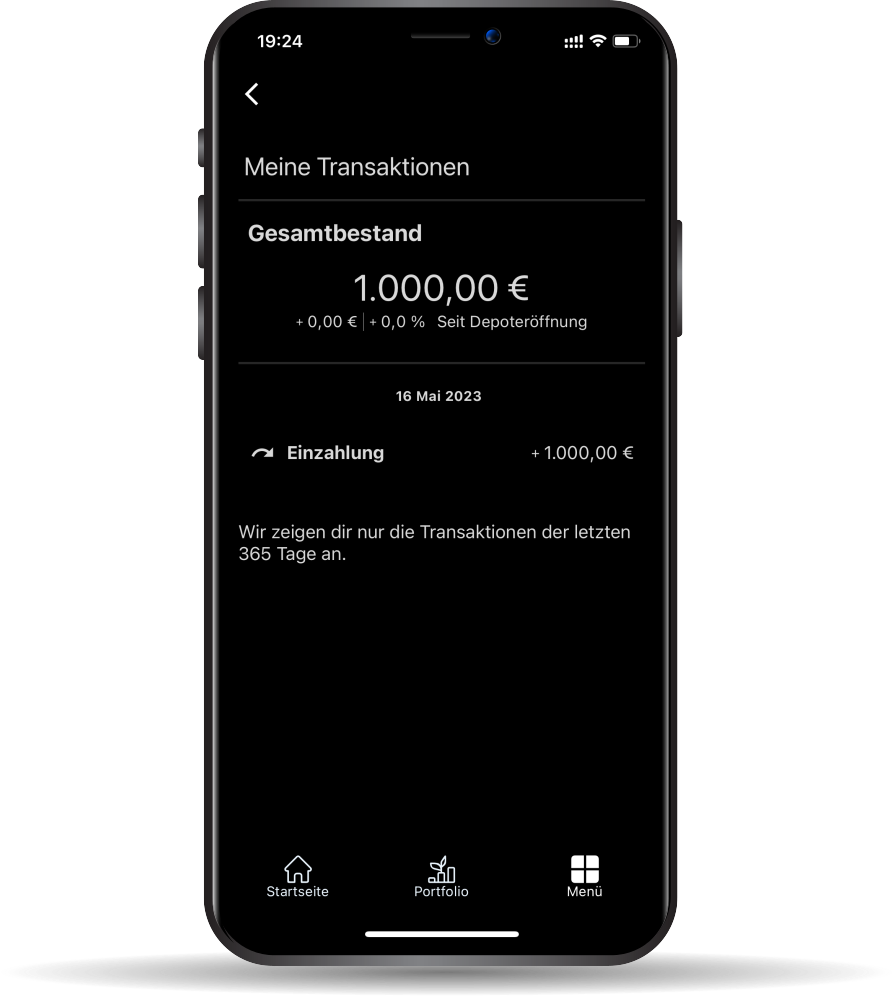

3. Pay in money

To invest your money, you just need to transfer it to your Goldmarie account. We can collect savings plans directly via SEPA direct debit. You can view and adjust your investment at any time.

Your security

We work with reliable partners to guarantee the safety of your deposits and transactions.

Your stocks are held in a stock depot at Baader Bank AG. You remain the owner of your securities. As a technology leader in digital banking services, Baader Bank ensures that all transactions are executed securely and fairly.

The composition and adjustment of your investment are determined by us and verified by investify S.A. This way, you benefit not only from our expertise in sustainability data and our innovative algorithms but also from the security guarantees of a state-regulated asset management.

How do we ensure sustainability of our investment portfolios?

In our stock portfolios, we not only focus on earning indicators and risk management but also consider the use of funds by companies. In order to be included in our stock universe, stocks must meet strict criteria.

The ecological-social orientation of our investments is audited by the renowned sustainability rating agency imug rating GmbH. As an independent player, they conduct ESG evaluations and sustainability ratings based on their own research and global databases. They draw on decades of experience.

The Sustainable Development Goals (SDGs) of the United Nations provide a framework for our value-based stock selection. The business activities of companies are evaluated in terms of their environmental and ethical-social impacts, and are categorized as harmful, non-significant harm (DNSH), or positive.

Our particularly ambitious approach has been examined by the "Forum Nachhhaltige Geldanlagen" and awarded the FNG seal. So, you can rely on an independent and reputable organization that monitors the consistently green orientation of our investment opportunities and savings plans.

Our exclusion criteria

Chemicals of Concern

Abuse of Animals

Civilian Firearms

Coal

Nuclear Power

Fossil Fuels Industry

Military

Pornography

Gambling

Unconventional Oil and Gas Involvement

Tobacco

Get control over the impact of your money

Adjust your investment goals to your own social or ecological standards. We guarantee the sustainability of your overall stock portfolio and optimize risk/return according to your needs.

Didn't find the answer?

Service Hours

| Monday | 11 a.m. h - 5 p.m. h |

| Tuesday | 11 a.m. h - 5 p.m. h |

| Wednesday | 11 a.m. h - 5 p.m. h |

| Thursday | 11 a.m. h - 5 p.m. h |

| Friday | 10 a.m. h - 4 p.m. h |

News

Webinar on 22.07: Finances for women Learn how to take control of your finances! A new study shows: Women invest more successfully when they do. This webinar is aimed specifically at women and focuses on sustainable investments. Find out why ETFs are not always green.

July 16, 2024

In this webinar, we will show you who our investments and savings plans are suitable for and how you can become a client. We will explain the differences between our Goldmarie Essential and Goldmarie Impact investment strategies so that you can choose the right strategy for you. Register now to join us on July 2 at 7 pm.

June 18, 2024

In the next webinar on 5 June, founder Caroline will explain the most important terms relating to sustainable investments such as "EU taxonomy", "ESG" and "SRI". Find out how you can recognise greenwashing and ensure that your investments make a positive contribution to the environment and society. Join in!

May 16, 2024

On 24 and 25 February, Goldmarie Finanzen will be live on the festival stage at FinTech 2024 in Berlin.

April 17, 2024

Gender pay gap: women earn 18% less than men. Promote equal rights! Sustainable investments for ecological and social impact.

March 8, 2024

Come to our free webinar on "Sustainable investing with Goldmarie Finanzen", meet founder Jennifer and ask your questions!

Jan. 23, 2024

Investments with FNG seal are professionally and transparently sustainable. This has been independently verified and monitored by an external committee. Our Goldmarie strategies have received two stars for their demanding sustainability strategy.

Dec. 19, 2023

We had the privilege of presenting on a stage at the leading start-up festival SLUSH in Helsinki. Founder Caroline represented Goldmarie Finance and gave insights into our sustainable financial solutions in an exciting live presentation.

Dec. 14, 2023

Come to our free webinar on "Sustainable investing with Goldmarie Finanzen", meet founder Jennifer and ask your questions!

Nov. 22, 2023

From November 13-16, we will be guests at the "most important tech conference in the world" according to Politico. The Web Summit is taking place in Portugal this year and is described by The Atlantic as the place "where the future is born".

Nov. 10, 2023

How can investments in the financial market be made easily accessible, securely managed and sustainable? Find out in the FE.MALE FOUNDERS Podcast, the podcast of the "Start-up Competition - Digital Innovations" by founder Jennifer.

Oct. 9, 2023

We met up with femtastics and talked about sustainable investments. We were asked what sustainability means to us and how we manage to ensure it in our investments.

Sept. 29, 2023

We are proud to be part of the nationwide strategy and to be able to promote sustainable development with our business model.

Sept. 27, 2023

There is more about this in the new issue of Focus Money. Now at the kiosk!

Sept. 6, 2023

The program supports women-led deep tech start-ups to develop into the tech champions of tomorrow. The 134 most promising start-ups from the EU member states and associated countries were selected.

Sept. 1, 2023

Yesterday we took part in the panel at the Hasso Plattner Institute on the topic of financing startups. Thank you for sharing!

Aug. 31, 2023

The time has come! From now on you can invest in your individual and sustainable portfolio.

June 30, 2023

How do digital innovations ensure a sustainable future? This and much more was discussed at this year's hub.berlin.

June 29, 2023

We were in the semi-finals at the startup incubator of the HWR Berlin, where female-led startups present their ideas.

June 20, 2023

We made it to the shortlist for the Women TechEU initiative! The program aims to support women-led deep tech startups.

June 19, 2023

Women can do finance! We prove this together with 26 other female experts in the current Portfolio Journal. In our article, we show how we use artificial intelligence to put together sustainable investments.

June 9, 2023

We were at the Digital Finance Conference this week and took 1st place among FinTech startups! We are very happy about the positive feedback.

May 5, 2023

We took 2nd place in the investment category at FintechWorld23. We are proud that we could convince with our innovative technology and our business model.

April 18, 2023

In the Finanzfrauen-Talk with Dr. Carola Rinker from SDK, founder Jennifer explains how the shares of the car manufacturer Tesla perform according to the sustainability rating of Goldmarie Finanzen. Watch the video on Youtube

April 12, 2023

We are looking forward to working with our partner investify TECH. Together, we will make our consistently sustainable portfolios available to conscious investors!

Jan. 10, 2023

If you would like to learn more about risk management of investments and our optimized portfolios, it is best to listen to the podcast of nur Bares ist Wahres!

Dec. 16, 2022

Why everyone should be a shareholder, what disadvantages ETFs have and what hurdles female founders face when building a startup, all the answers in our interview with Geldmarie...

Dec. 8, 2022

The founder of Goldmarie Finanzen, Dr. Caroline Löbhard will deliver the keynote for the opening of BSBI's new campus in Berlin. We are looking forward to the exchange!

Nov. 28, 2022

Webinar: On 24.11. at 7pm Goldmarie is invited to talk about the topic "Private investment forms in times of rising inflation".

Nov. 23, 2022

Last week Albrecht Kümmerer from Baader Bank visited us in Berlin :) We are looking forward to the cooperation!

Oct. 19, 2022

A milestone for Goldmarie: We are funded by the ProFIT program of IBB :)

Oct. 3, 2022

We are part of the K.I.E.Z. Accelerator starting Oct. 2022!

Sept. 15, 2022

Join us: the winners of the 2022 summer round of the start-up competition - Digital Innovations present their business ideas live at the Demo Day!

Sept. 5, 2022

Goldmarie was awarded as one of the Top Digital Innovation Startups in the BMWK startup competition :)

Aug. 29, 2022

We published a new video!

July 22, 2022

Image: wikifolio

Webinar 6th July, 6pm. Goldmarie founder Jennifer talks to other wikifolio traders about the topic "Renewable or fossil energy - pure conscience vs. pure return?"

July 5, 2022

We are nominated for the Generation-D award: vote for us on LinkedIn and help us get into the finale!

May 27, 2022

We are among the Top51 Startups in the summer edition 2022 of the startup competition Digital Innovations :)

May 20, 2022

Come to INVEST in Stuttgart 20-21.5 and meet Jennifer from Goldmarie in person! Info and tickets:

May 11, 2022

On May 10, 3 till 4 pm we are invited to talk about sustainable entrepreneurship. Feel free to come by!

May 4, 2022

Image: Designed by pch.vector / Freepik

If you want to invest your money in equities on a sustainable basis, you essentially have three options.

April 27, 2022

The financial rocker invited us for an interview for his podcast. Thanks for the interesting talk and rock on! :)

April 13, 2022

Image: Zero waste photo created by freepik

Private investors are becoming increasingly aware of the social and ecological effects of investments. But not all providers are as green as they seem.

March 28, 2022

Image: Designed by pch.vector / Freepik

Women, women-be-courageous-and-take-risks: Why women invest their money less than men and what you can do about it

March 8, 2022

Image: Bild: FaceMePLS

The global community is looking on in horror at Putin's aggression against Ukraine. We, too, have paused and thought about how our business concept fits into these times.

March 2, 2022

Interested in our notion of sustainability? We just published an article . . .

Feb. 14, 2022

We published a new article about the performance of our algorithm.

Feb. 7, 2022

Refinitiv published our tutorial on mathematical modeling of sustainability impact.

Jan. 7, 2022

Investing for climate: Caroline Löbhard and Jennifer Rasch explain what is important with regard to green and socially fair investments.

Jan. 6, 2022

We are now in the INVEST data base of the German Federal Ministry of Economics and Climate Protection :)

Dec. 15, 2021

The ecological and social orientation of the companies in our portfolios is rated by imug. We are happy about collaborating with such a renowned partner!

Nov. 1, 2021

We won second place in the Future Finance category of the University Innovation Challenge 2021 organized by Handelsblatt and Goethe University.

Oct. 25, 2021

Introduced: Five new fintechs that we don't know yet

Sept. 7, 2021

At the Business Plan Competition, we were among the finalists several times and made it to Top 6 overall.

June 17, 2021

Jennifer Rasch is invited on 20.05. in the DeepDives from 17:30 as a speaker on the topics "Where to invest now?".

May 20, 2021

If you missed our webinar "Investing money in sustainable stocks" at Flatex, you can catch up on Youtube!

March 16, 2021

We are happy to announce that Goldmarie Finanzen is funded by the EXIST Start-Up Grant since March 2021!

March 12, 2021

Image: Steve Brookland / Imago Images

When looking for a good investment, mathematician Jennifer Rasch didn't find what she was looking for right away. "The offers I found were not sustainable enough for me", she recalls.

Feb. 9, 2021

Our new wikifolio is investable! This portfolio is based on a minimum volatility approach, which ensures maximum diversification! Of course consisting only of sustainable companies :)

Jan. 28, 2021

The founders of Goldmarie Finanzen demonstrate how to optimize a portfolio by adding ESG constraints and show how this can lead to improved performance as well as better outcomes for the planet.

Jan. 25, 2021

Sustainable investing will be a hot stock market story in 2021: In the coming years, the aspect of sustainable investing is likely to be much more in the focus of investors again.

Dec. 29, 2020

Sustainable financial investment advice Goldmarie: "No compromise on climate protection and social compatibility".

Nov. 17, 2020

Image: wikifolio.com, Goldmarie Finanzen

With artificial intelligence to sustainable success: A blog article about us and our investment strategz at Wikifolio.

Oct. 1, 2020

We are supported by