Individually optimized Investments

You have your own, ambitious ideas about sustainability? Nevertheless, you want to diversify your investment based on modern technology and the latest scientific findings?

Then you came to the right place!

Visit YouTubeDetails on our investment strategy (German)

Does this work in practice?

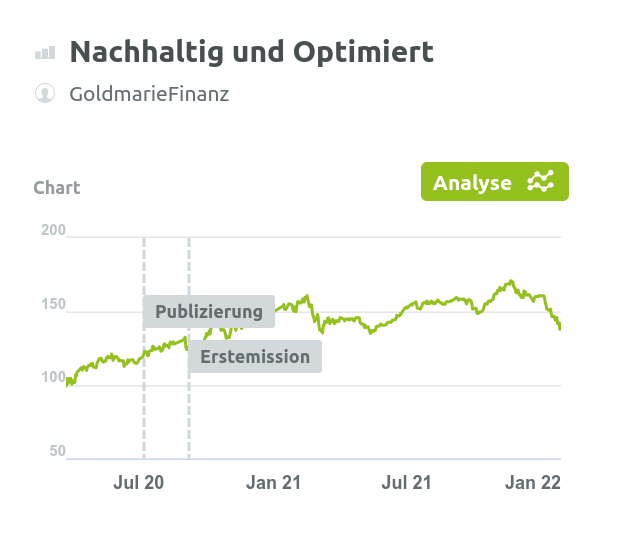

Proof of concept: wikifolio

wikifolio is a social trading platform where financial experts (and those who want to become one) can show their investment strategy. If certain conditions are met, the wikifolio can become investable for investors.

A rapid start …

We have been managing the model portfolio „Nachhaltig und Optimiert“ since the end of March 2020. Hundreds of investors have already invested a total of 500 000 €.

Visit Nachhaltig und Optimiert

… and a solid sequel

In September 2020, we launched the wikifolio „Diversifiziert und Nachhaltig“. Both portfolios are based on our algorithm, „Nachhaltig und Optimiert“ focuses more on returns, „Diversifiziert und Nachhaltig“ is more broadly diversified.

You've got your standards …

Strict criteria

Every stock in a Goldmarie Portfolio satisfies strict sustainability criteria.

Imug rating supports our selection method and guarantees objective third party rating.

You will see the difference to so-called green ETFs.

Read more . . .

Transparency

You are seriously concerned with Climate change, ambitious with sustainability, and you want to know where your money is invested? Sustainable stocks are just the right thing for you.

Individual

We compose your investment just to your taste: Decide, which goals are most important for you, and integrate your existing investments!

… and have the technology

Objective selection strategy

We don't rely on emotions but rather trust an approved mathematical model.

Our strategy builds on modern scientific methods and is conscientiously tested against historical data.

Read more . . .

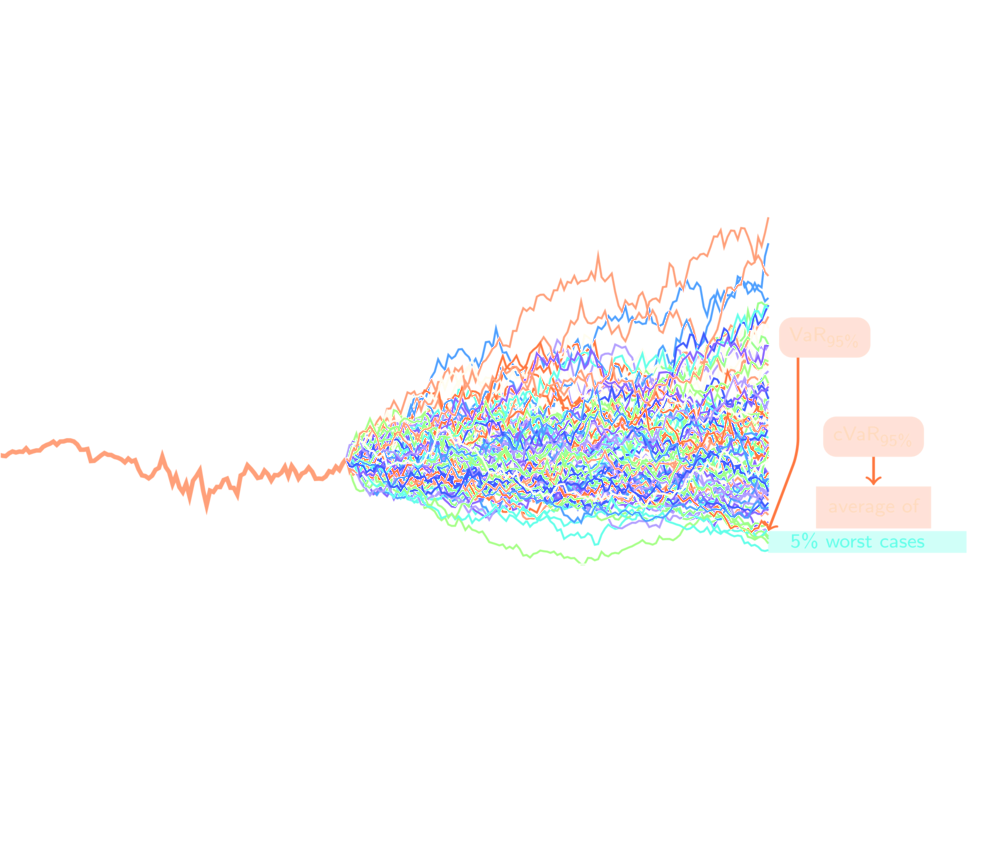

Safety through diversification

In a good portfolio, stocks are combined such that variations in the spot prices compensate each other. In this way, losses can be limited.

Our expertise becomes your advantage

We are scientists with an emphasis in mathematics and computer science. To find a well-composed portfolio, we employ a lot of expertise and of course . . . a computer ;)