By Caroline Löbhard, Feb. 7, 2022

What are sustainable shares?

In times of green-washing, it is important to research, what kind of sustainability an investment really satisfies. We explain our notion of sustainability and show selection criteria and processes.

Goldmarie Finanzen compiles stock portfolios in a process that includes the use of funds as a criterion in addition to classic investment indicators such as return and modern risk management. This is to guarantee ecologically and socially sustainable investments.

Basically, Goldmarie Finanzen follows the exclusion principle &emdash; all financial investments are compiled from a selected, screened stock universe. That is, Goldmarie Finance sets criteria that an investment instrument must meet in order to be included in a Goldmarie portfolio. The rating agency imug rating uses these criteria to determine which companies and financial instruments can be included in the investment universe. In an innovative model, customers can also enter their own preferences via a web platform, for example by excluding companies or preferring certain business areas. The investment is ultimately put together by an automated decision-making process. Classical variables such as the expected return or risk measures play a role here. In addition, preference can be given, for example, to sectors, business areas or even sustainability targets.

Basics in sustainability evaluation

Providing a framework for value-based investment

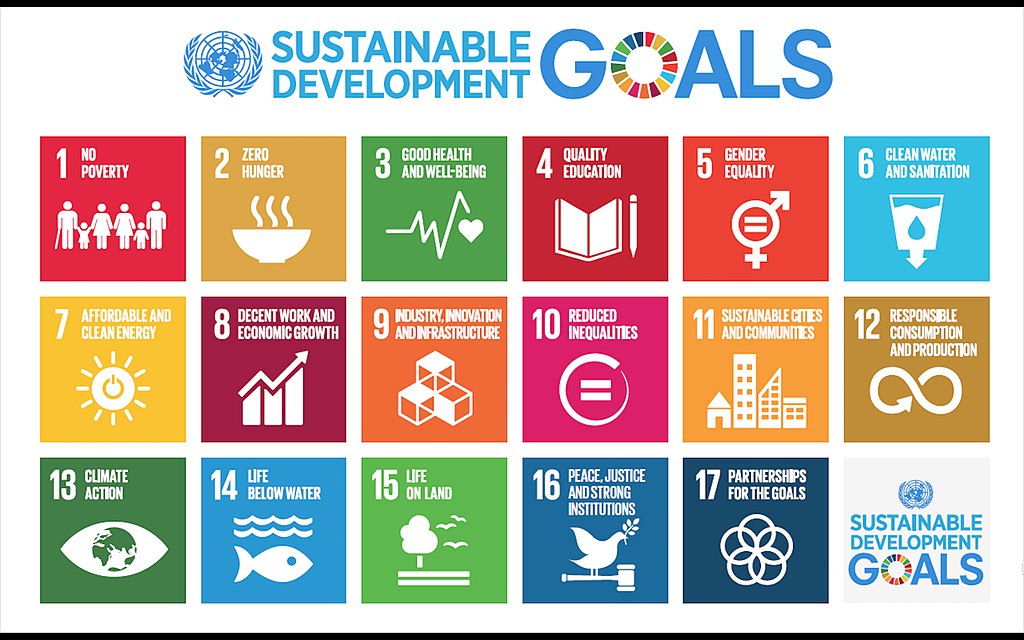

- die 17 Ziele nachhaltiger Entwicklung (sustainable development goals, SDG) from the UN Paris Climate Protocol of 2015;

- EU Taxonomy Regulation and Draft delegated act;

- Sustainability seals such as the FNG Siegel;

- Criteria catalogs of traditional issuers of environmental and social funds, such as Fairworld Fund, der Oekoworld or GLS-Bank.

EU Taxonomy Regulation

Since the early 2000s, sustainability reporting standards have been developed and gradually incorporated into corporate reporting requirements. The previously prescribed data in the area of ESG (Ecological, Social, Governance) are only of limited value. The EU Taxonomy Regulation of 2020 marks a turning point: From 2022, companies that are required to report non-financial information (par. 289b et seq., 315b et seq. HGB) must classify their business activities in terms of their environmental sustainability and relate them to sales revenue, capital expenditure and operating expenses. Thus, for the first time, non-financial information will be mandatorily linked to financial information. From 2023, an analogous reporting requirement is to apply to ethical-social sustainability. This information will form the basis for pre-contractual information and reports on financial products.

An economic activity is considered to be ecologically sustainable according to article 3 Taxonomy Regulation, if

The environmental objectives are defined according to Art. 9 Taxonomy-Reg.

- Climate protection;

- Anpassung an den Klimawandel;

- the sustainable use and protection of water and marine resources;

- the transition to a circular economy;

- Pollution prevention and control;

- the protection and restoration of biodiversity and ecosystems.

The evaluation criteria for the environmental targets will be further specified in a delegated act.

Limits of the EU taxonomy

The Taxonomy Regulation is welcomed among development and environmental experts as it makes corporate data much more meaningful and comparable. Nevertheless, the reporting data of the EU Taxonomy Regulation is not sufficient for a rigorous sustainability assessment:- A regulation on social-ethical sustainability has not yet been adopted.

- There are currently still some differences in the exact formulation of the environmental sustainability conditions; the corresponding delegated act has not yet been adopted.

- For a reliable sustainability assessment of companies, assessments by external, neutral experts are always necessary in addition to the company's own internal reporting data.

- The reporting requirements only apply to large companies with 500 or more employees. It is currently difficult to estimate how many young, ecologically-socially oriented companies with innovative strength and growth potential voluntarily make reporting data available.

Goldmarie Finance exclusion criteria

As part of a Controversial Activities Screening (CAS), imug rating evaluates business activities that compromise ethical, social or environmental goals. The following activities result in exclusion from all Goldmarie Finanzen investments.

Animal welfare

- x Production of cosmetic products tested on animals - Manufacturers

- 3Rs Responsible animal testing for medical purposes only acceptable with adoption of Reduce, Refine and Replace policy

- x Production or sale of fur products

- x Intensive farming operations

Chemicals of concern

- x Production of restricted chemicals

- x Manufacturers

Civilian firearms

- 5 Production or sale of civilian firearms acceptable if less than 5%

Coal

- x Thermal coal mining

- 10 Coal-fuelled power generation acceptable if less than 10%

Fossil Fuels Industry

- x Fossil fuels industry - Upstream

- 10 Fossil fuels industry - Midstream acceptable if less than 10%

Gambling

- 5 Gambling operations or products acceptable if less than 5%

Military

- 5 Military sales acceptable if less than 5%

- x Controversial weapons

- x Financing of cluster munitions or anti-personnel landmines

Nuclear power

- 5 Turnover from nuclear power acceptable if less than 5%

- x Uranium mining

Pornography

- 3 Pornography and adult entertainment services acceptable if less than 3%

Unconventional oil and gas Involvement

- x Tar sands and oil shale extraction or services

- x Offshore arctic drilling

- x Hydraulic fracturing

Tobacco

- x Production of tobacco

- x Production of e-cigarettes

Norm-based screening

In addition, imug rating conducts a standards-based screening to detect violations of the United Nations Global Compact. A serious violation of the standards below will lead to exclusion.

Human Rights

- v Fundamental Human Rights

Labour Rights

- v Fundamental Labour Rights

- v Non Discrimination

- v Child and Forced Labour

- v Social Standards in the Supply Chain

Environment

- v Environment

- v Environmental Standards in the Supply Chain

Corruption

- v Social Standards in the Supply Chain

Optional exclusion criteria for individual decisions

For many business activities, there is a broad social consensus as to whether they are social and environmental. For others, it is not so clear. For the business areas listed below, our customers can decide for themselves whether (and at what threshold) it should lead to exclusion from their personal investment.

Alcohol

- ? Production of alcoholic beverages

Animal welfare

- ? Manufacturers of non-cosmetic products tested on animals

- ? Distributors of non-cosmetic products tested on animals

Cannabis

- ? Production of cannabis

Genetic Engineering

- ? Production of GMOs for human consumption

Human Embryonic Stem Cells

- ? Research on human embryonic stem cells

Focus topics for individual objectives

Imug rating provides information about positive contributions of companies in the topics mentioned below. Our clients can choose one or more of these topics as their investment focus and will then receive preference for corresponding positions in our investment proposal. A low carbon footprint can also be can become a condition or criterion for portfolio selection.

Access to Information

- + Access to ICT

- + Data service provider

Capacity Building

- + Access to education

- + Educational materials

Energy & Climate Change

- + Access to energy

- + Afforestation

Food & Nutrition

- + Basic/Fresh food

- + Early life food

Health

- + Animal pharmaceuticals

- + Healthcare materials

Infrastructure

- + Affordable housing

- + Infrastructure to withstand disasters

Responsible Finance

- + Access to banking

- + Access to insurance

Water & Sanitation

- + Access to water

- + Rainwater harvesting

Protection of Ecosystems

- + Bio-based chemicals

- + Contaminated site rehabilitation