By Jennifer Rasch, April 27, 2022

3 ways to invest in sustainable shares

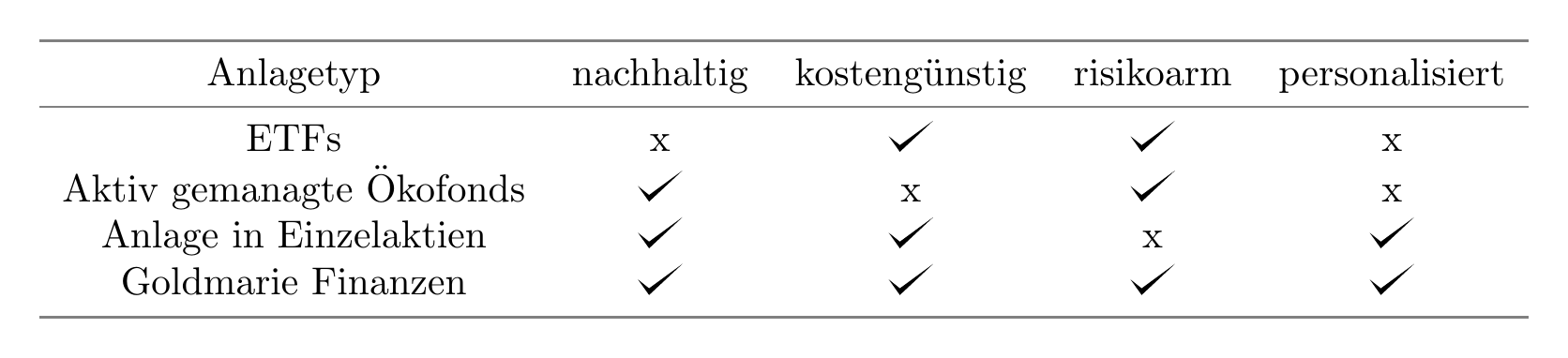

If you want to invest your money in sustainable shares, you have three main options: Sustainable ETFs, actively managed eco funds, or an investment in sustainable individual stocks.

"Sustainable" ETFs

ETFs are passively managed index funds and are considered low-risk and low-cost. However, so-called sustainable ETFs are mostly based on the so-called "best in class" approach, i.e. they invest in companies that strive for betterment in their actually controversial industry. However, this approach is highly controversial due to its relatively loose standards regarding sustainability.(Sustainable investing ). Therefore, sustainable ETFs are not a good option for investors who have strict sustainability requirements.

Actively managed eco-funds

Renowned eco-funds apply strict sustainability criteria when selecting individual stocks, which are carefully checked by a team of experts. (see also What are sustainable shares?) However, this service has its uses Price. Fixed costs of 2.5-3% per year are not uncommon and reduce the return. With some providers there is an additional sales charge (ie a one-time entry fee) of up to 5% (as a percentage of the investment).

Company participation through shares

In principle, private investors also have the opportunity to buy shares in individual companies directly. Free online depots with very low transaction costs pave the way there, for example with providers such as Onvista or Trade Republic. Here, however, the difficulty arises for the layman to select suitable individual titles and combine them in such a way that the risks are balanced and a good return is achieved.

Goldmarie Finanzen offers a remedy here

Goldmarie offers the ideal product for investors who have high demands on sustainability criteria, but at the same time want an optimal risk-return ratio. We compose portfolios of sustainable stocks that are optimized using our innovative risk-return algorithm. In order not to miss our market launch, click here for our Newsletter.